- Home

- Fund Evaluation

- The process of Fund Evaluation / Evaluation Points

The process of Fund Evaluation / Evaluation Points

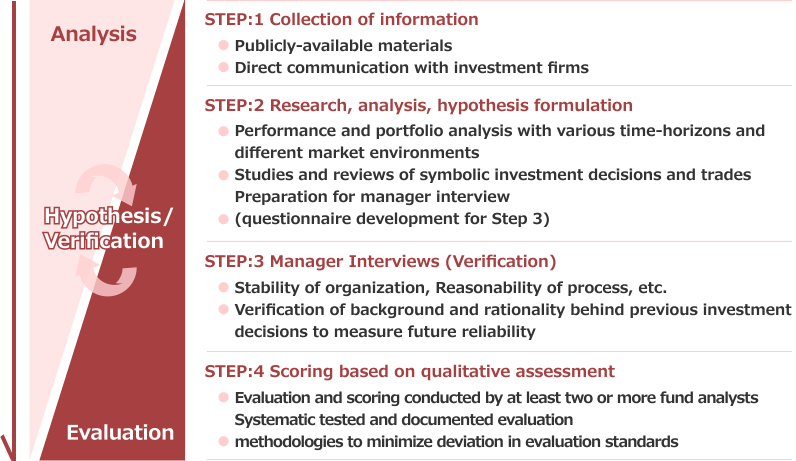

We have been constructing our own fund evaluation process since 1996. In our process, the evaluation starts from gathering information of funds and managers and conducting multilateral analysis of such information to set up hypotheses on why the fund is well or poorly managed. Then, we test those hypotheses through on-site due diligence including management and other professional interviews.

Fund Evaluation Approach

Evaluation points

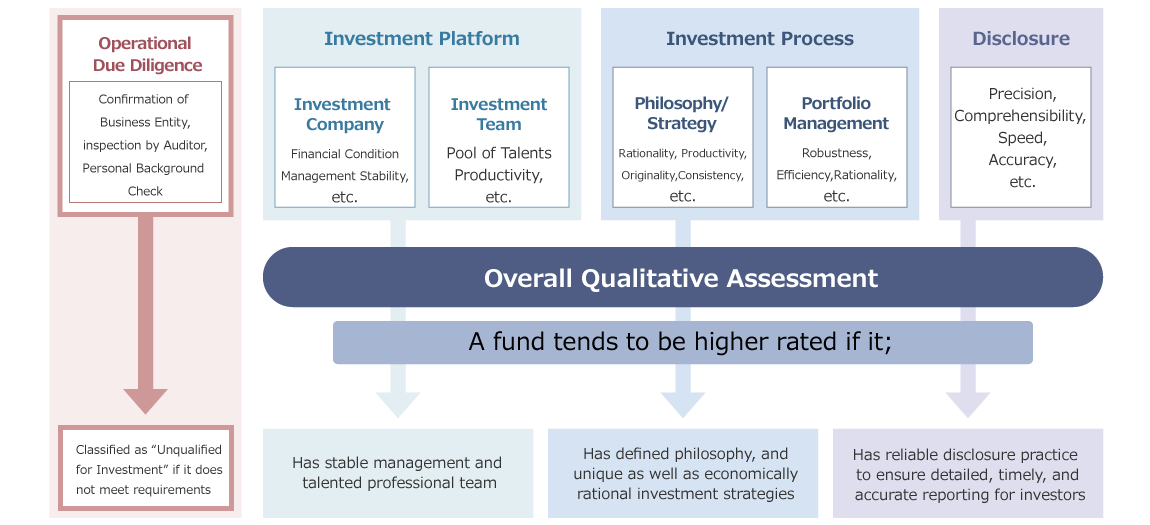

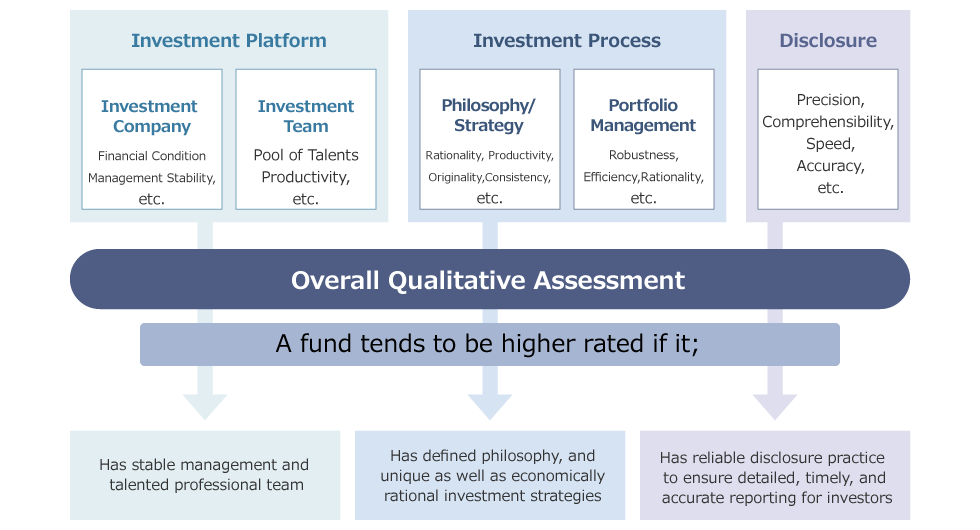

Most of the evaluation items are common regardless of their investment universe and strategies. However, additional items are reviewed to address natures.

There are 3 categories in evaluation points to be reviewed for traditional investment assets and strategies.

As for hedge funds, evaluation points can also be grouped into the same 3 categories.

In addition, operational review is conducted in order to assess operational risks leading to fund’s breakdowns, such as concealment of investment failures, fraud accounting, and auditors’ inability to access evidences of such wrong-doings. Operational review may result in classifying the fund as “Unqualified for Investment” depending on the nature of its findings.