- Home

- Fund Evaluation

- Our Focus on Qualitative Evaluation

Our Focus on Qualitative Evaluation

After years of analytical work and seeking better investment performance for our clients, we came to the conclusion that qualitative evaluation is the key component for fund evaluation. We do not consider past performance as an indicator for the future performance. We believe that it is qualitative analysis that assesses future expected performance and adds value to our clients.

Qualitative Evaluation and Quantitative Evaluation

There are two approaches in fund evaluation. Quantitative Evaluation measures the funds’ historical performance records.

Qualitative Evaluation evaluates qualitative aspects of funds and assesses their reliability to generate expected level of returns in the future. Since market and management environment including key investment personnel for the fund changes over time, we should not depend solely on historical performance which could have been generated before those changes.

- Quantitative Evaluation

-

Past Performance

It measures funds’ historical returns relative to risk taken against expectation and/or target.

- Qualitative Evaluation

-

Reliability for the future performance

It assesses funds’ likelihood to generate higher returns beyond expectations and/or targets with given and/or budgeted risks in the future.

Differentiation from our peers

Objectives and Methodologies of Fund Evaluation

- We clearly define the objectives of our fund evaluation is to measure medium to long term attainability of a fund’s expected performance.

- We implement only qualitative evaluation which guides us to select “good” funds with positive expected future performance.

- We only analyze funds’ historical risks and returns to analyze their previous investment decisions but never conduct quantitative evaluation by measuring and ranking them.

Research Platform

- Our in-house research platform covers a large number of managers globally and is one of the largest relative to our Japanese peers.

- Our coverage ranges from traditional investment strategies to alternative as well as private market investment strategies.

- We work with prominent US and European research houses to access their findings as a kind of second opinion.

Frequency and Consistency of Qualitative Evaluation

- We decide which fund and when to cover as an entire research team by following our policy and do not provide the analyst in charge with discretion. We continue to evaluate the fund once we initiate its coverage until it is fully redeemed.

- We review funds on a regular basis, sometimes as frequently as monthly relative to the fund size, type or expectations of our clients.

Standardization and Evolution of Evaluation Process and Methodologies

- Evaluation process and methodologies are documented and shared by all analysts following standardized research criteria and evaluation templates.

- Such standardization eliminates as much key-man risk as possible in NFRC’s fund evaluation services.

- Evaluation methodologies have and will evolve over time resulting from a consistent and systematic review process.

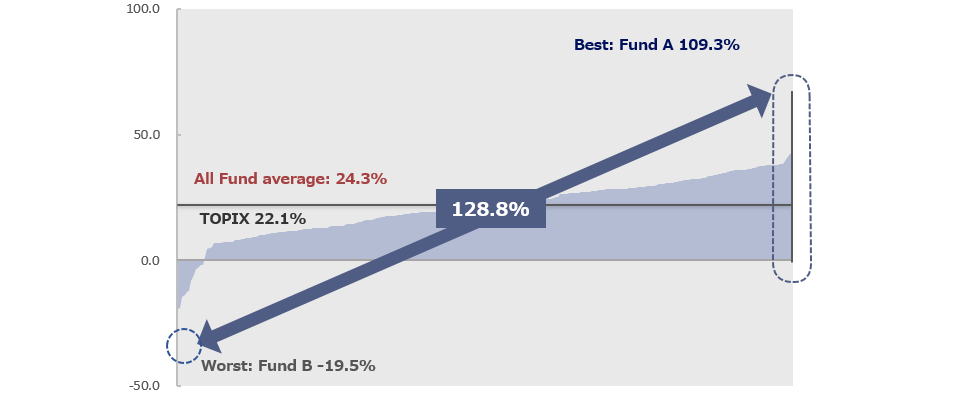

Contribution to Investment Performance

- We continuously monitor the correlation between a fund’s qualitative rating and its performance after the rating is provided. The results and data from such monitoring are disclosed upon request.

- We use our qualitative rating as an important part of our advice for fund selection as well as portfolio construction for our clients, because of our belief that our rating adds value contributing to clients’ investment performance.