- Home

- FoFs Investment Advisory

- Investment Solution to Address Clients’ Needs

Investment Solution to Address Clients’ Needs

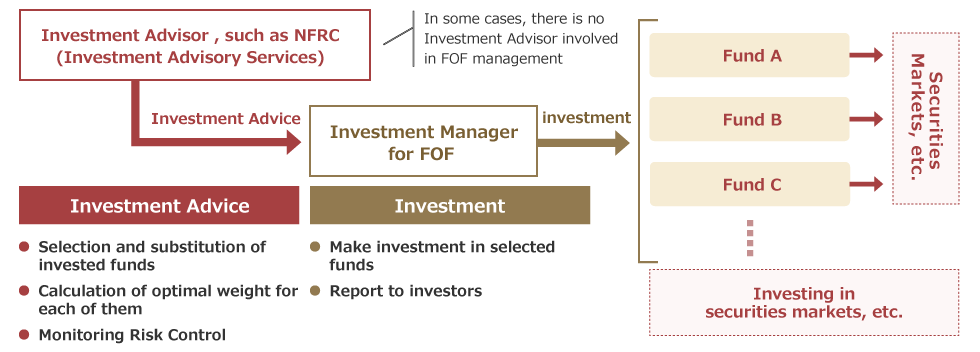

We advise fund selection and optimal combination of fund portfolio in our investment advisory service. We believe that our advisory service will provide clients a variety of custom-made investment solutions such as total supports of client’s portfolio construction and fund of funds (“FOFs”) advisory.

Overview

Investment Advisory for Fund Selection and Combination/Optimization of Fund Portfolio

Based on our fund evaluation, we select the world’s best quality funds and advise combination/optimization of fund portfolio to meet a variety of customer’s needs. In case of fund of funds portfolio advisory, with the latest financial technologies, we seek to create unique risk/return characteristics which a single fund cannot deliver, and improve return per risk.

Fund Monitoring to provide risk management and portfolio construction for longer term

Once a fund is selected, it is monitored continuously. If it is not satisfactory, it is subject to exclusion from the short lists for new funds or to be replaced for new names. Through monitoring, we can support a client’s total portfolio for a longer term. We also can provide monitoring reports for clients, if necessary.

Diversification of Investors’ Assets with Broad Fund Research Coverage

We advise portfolios which help investors to efficiently diversify their investments across asset classes. We have wide coverage and extensive research experience, especially in global and emerging market equities, investment grade and high yield bonds, emerging country bonds, REIT, hedge funds, and domestic large and small-cap equities.

Example (1) Our Investment Advisory Services for Asset Management Companies Managing Public Funds in FOFs structure

Case 1

Clients’ Needs

One of the companies launches a global balanced fund investing in both equities and fixed-income securities to meet investor’s needs in Japanese DC plan to build their long term wealth. They want to create a global balanced portfolio in a FOFs structure by collective investment expertise of selected money managers from the world. They request us to advise them in the selection of managers with respect to each asset class and the size of the assets allocated to each selected manager. They also ask us to continue to review the quality of the selected managers, expecting us to monitor changes in their quality and to advise their substitution if necessary.

Our Advice

Upon launch of the fund, we advise the asset management company of long-term asset allocation, selection of the funds which should be invested in the FOFs and their respective weights. We continue to monitor the quality of the invested funds and report the monitoring results to the company while advising substitutions of the invested funds if necessary.

Case 2

Clients’ Needs

Another asset management company launches a focused ?fund to invest solely in a particular asset class by collecting skills of selected managers worldwide through a FOFs structure. The company requests us to run the selection and advise a list of managers and their respective weights they should use in the portfolio and to conduct on-going review of their quality after the launch.

Our Advice

When the company starts management of the fund, we advise the company the selection of the funds and their weights in the FOFs portfolio. We monitor the funds’ quality for the company, keep the company informed of any changes found in their quality, and recommend substitutions for troubled funds.

Example (2) Our Investment Advisory Services for Asset Management Companies managing assets of Pension Sponsors

Case 1

Clients’ Needs

An asset management company aims to create products for public market investments in FOFs structure by collecting selected skilled money managers globally and combining their expertise in optimal weights in order to target stable returns which large pension plans seek to achieve.

Our Advice

Before the launch of the product, we not only advise the company of the list of the managers and their weights in the portfolio, but also help the company to negotiate terms of the mandates and investment guidelines with those selected managers based on our research and analysis made through the selection. After its launch, we continue to review whether their expertise meets our expectations and advise the company to substitute disappointing managers.

Case 2

Clients’ Needs

Another asset management company plans to tap growing demand for private market investment such as private equities among pension plan sponsors. However, they have limited investment experience in such markets, if any, and very little understanding of the nature and practices of the markets. The company requests us for the private market investment, not only to advise selection of the good managers with their weights in the portfolio and continued review of their quality, but also to support the company to meet various requests from sponsors and to write periodical client reports in easy-to-understand manner.

Our Advice

For private market investments, we provide the asset management company with extensive support to address all the questions and concerns from pension sponsor clients, in addition to all the things we do for the public market products as in (case 1) above.

Example (3) Our Investment advisory Services for Institutional Investors

Clients’ Needs

■An asset management company considers launching a global-balanced fund to meet demand for a diversified investment from conservative institutional investors. They traditionally buy and hold domestic fixed-income securities until maturity for their asset management, however, such activities do not generate meaningful returns under the current environment and they have no other choice but to invest in other asset classes. The company wants to develop a single fund which helps investors without expertise to invest in different types of assets globally.

■The company deems that the fund will pay out dividends periodically, so that investors are able to achieve profit from investment without liquidation. The fund should diversify its investments in different markets including high-yielding equities and fixed-income so sources of dividends are also diversified and actual investments are outsourced to skilled managers from all over the world in FOFs structure.

■The company asks us to advise manager selection and respective weights from early stage of product development.

Our Advice

■We provide model portfolio with the asset management company as the basis of management of the new FOFs, including selected funds for investment and their weights.

■In designing the model portfolio, we utilized model portfolios from existing FOFs which we have advised for a long time, in order to make risk/return profile of the new FOFs easier to image..