- Home

- FoFs Investment Advisory

- Sample of Portfolio Construction

Sample of Portfolio Construction

Concepts and Objective in Portfolio Construction

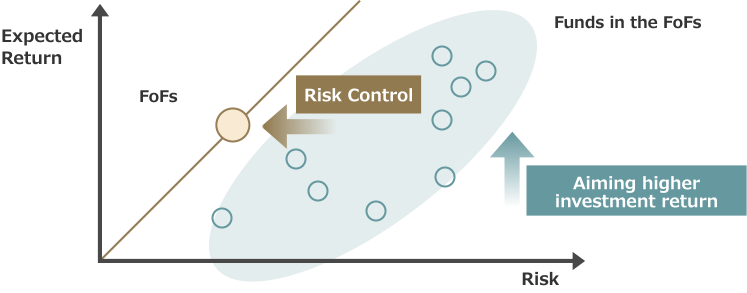

With our qualitative analysis, we can select funds with higher expectation, and seek highest and most stable portfolio performance by our technology to optimize fund weighting. We construct fund portfolios to achieve target investment return for more controlled risk within the guideline of the Fund of Funds. We are Japan’s largest full-time fund investment advisor for AUA, and thus have a certain level of fee bargaining power against target fund management companies.

Sample of Portfolio Construction

NFRC holds own fund data base that combines the latest commercial data base sources(total approx. 350,000+) and its own source (approx. 2,500+). The Chart below indicates how we proceed to evaluate funds in selecting Japanese Equity Fund of Funds.

NFRC Database

Apx. 2,500+ names

NFRC Original Database

Apx. 350,000+ names

Commercial Database

1,000+

Funds mainly investing in Japanese Equity

with more than 3years of track records

About 800

1st Universe

Quantitative Data Analysis of various aspects

About 200

2nd Universe

Suitability check for the planned characteristics of FOF

and the additional candidates following such checks

About 50

Qualitative Analysis Universe

Reviewing our historical research information and other public information

8

In-depth Qualitative Analysis

On-site manager interview. Qualitative assessment, Business commitment, etc..

4

Final Selection