- Home

- Private Asset

Private Asset

Demand for Private Asset Funds has been steadily increasing. NFRC covers and provides research for a wide range of asset classes and strategies, such as Equity, Debt, Infrastructure, Real Estate, etc.

In-depth Research through Qualitative Evaluation

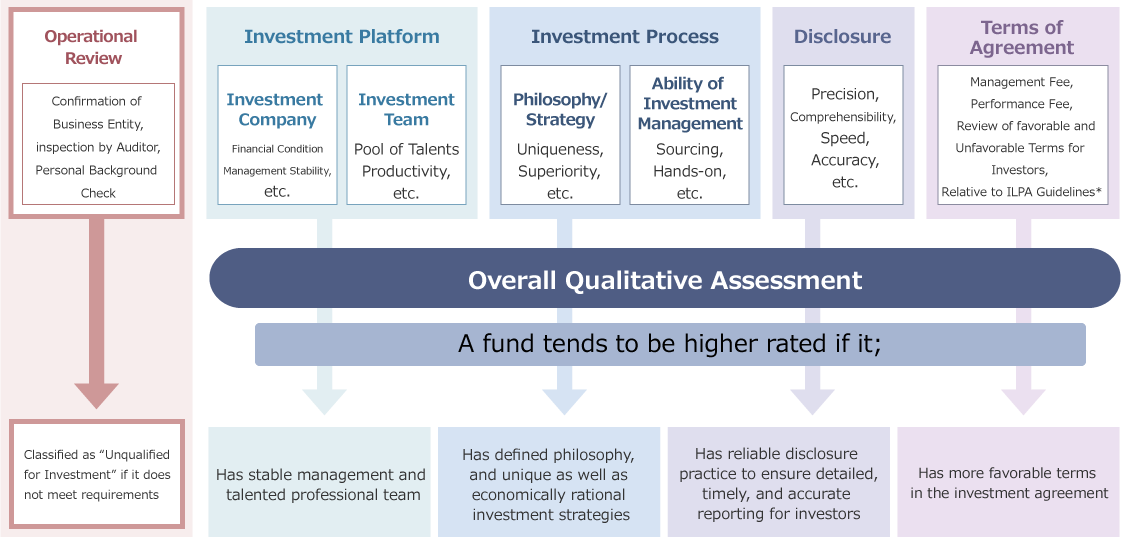

With the same basic methodologies of qualitative-evaluation as Traditional Asset Funds, we conduct research recognizing the uniqueness of Private Asset Funds with relatively limited information. We focus on not only investment aspects but also perform operational review and carefully review contractual terms.

Private-Asset Funds

Similar to traditional fund and hedge fund research, private asset fund research also places a heavy emphasis on the evaluation points within the investment platform, investment process and disclosure. Additionally, private asset fund research also includes a careful review of the contractual terms between managers and investors since they are unique to each fund.

Since the investment time horizon is generally longer in private market investments, operational review is a critical part of private asset research. A longer duration of the agreement and the managers’ fiduciary duty can magnify any differences in the robustness of its operational capabilities.

(*)Private equity principles released by ILPA (Institutional Limited Partners Association), which consists of three guiding principles, 1.Alignment of Interest, 2.Governance, 3.Transparency

Global Research Platform and “On-site” Research Policy

As with traditional asset funds, analysts for Private Asset Funds are stationed globally to provide local research coverage and expertise. This facilitates highly valued “On-site” meetings in timely manner.

Tokyo

12analysts

London

1analysts

New York*

4analysts

As of March 31, 2024

(*)ODD analysts are included in New York head count

- Number of Contacts with Managers since incorporation as of Mar, 2024

-

- Europe

- 233

- Asia・Oceania

- 463

- Japan

- 205

- North America

- 331

- Global

- 278

- Emerging

- 65

20+years Experience and Track Record of Research for Private Asset Funds

As a research pioneer, we have over 20 years of research experience and track record in Private Asset Funds that have recently seen a growth in demand. NFRC’s experience provides added value during changing market environment. As a result, we have received entrusted assets of JPY2.1T(*) in Private assets funds from our clients.

(*) As of September 30, 2023