- Home

- CIO

CIO

CIO*Services involves using Nomura’s highly value added advisory models with the goal of “Extending our asset management services usually provided for institutional investors such as public and corporate pension funds to retail investors”.

*CIO: Chief Investment Office

Mid-to-long term Asset Allocation ~SAA(Strategic Asset Allocation) ~

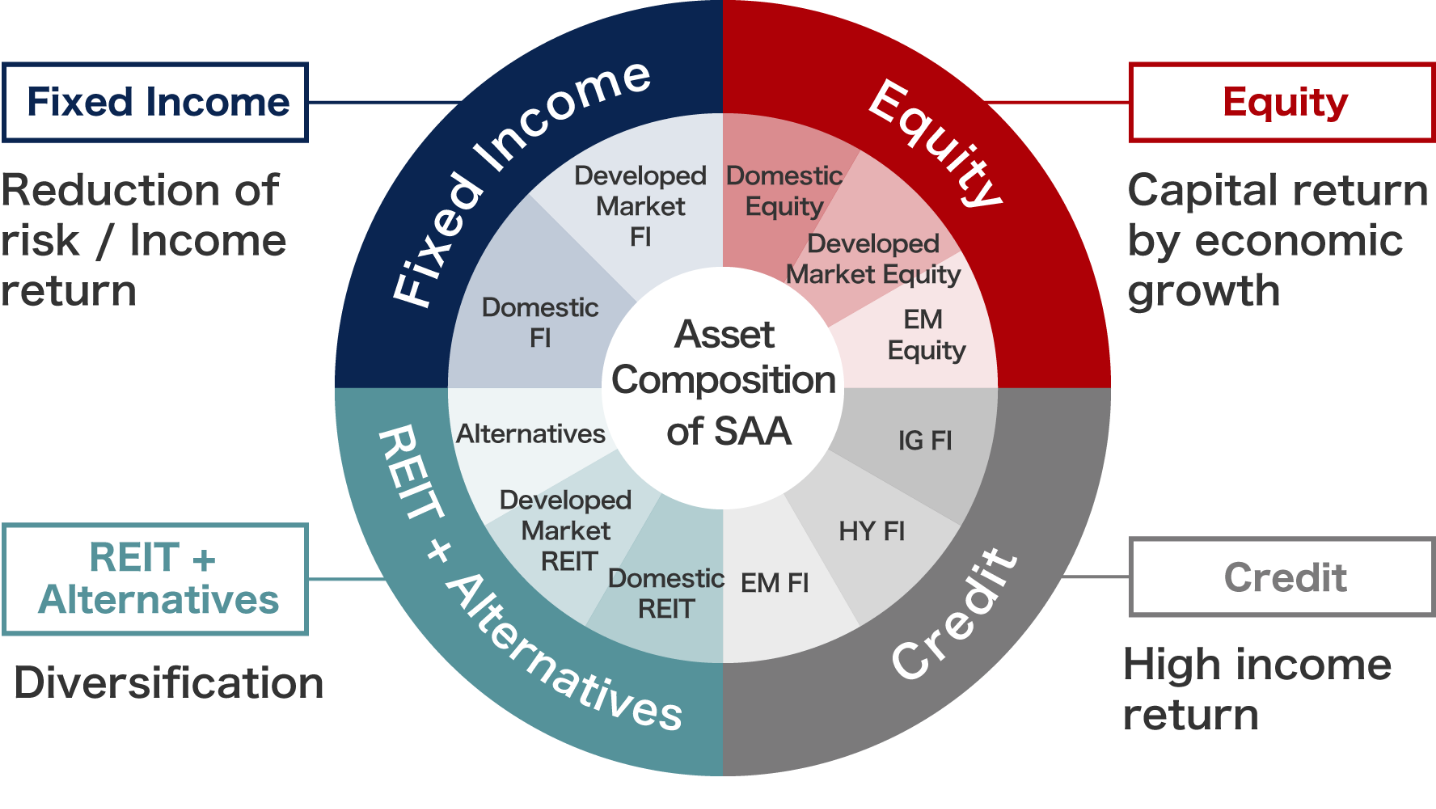

We build asset allocation with high investment efficiency over a five year time horizon. The features of our CIO are ①improvement of investment efficiency by diversifying in broad asset classes, ②benefit from global growth emphasizing on allocation for overseas, and ③income gain oriented focusing on credit investment. SAA defines eleven asset classes and diversifies into these various asset classes.

1.Improve Investment Efficiency

Improving investment efficiency with diversification into a broader range of asset classes

2.Shifting to Global Markets

For both Equity and Fixed Income, emphasizing on global allocation to benefit from global growth

3.Focus on Income Gain

Enhancing income gain, investing in high-yield credit as well

Tactical Asset Allocation ~TAA~

We provide a view of overweighing / underweighting on each asset class for the next six to twelve months. Deviating from SAA intentionally, we aim to gain any excess return. Positions are made by a combination of our proprietary quants model and qualitative judgement of fully-experienced strategist.

1.Fair Value

Aiming to gain excess investment returns base on the belief of market prices reverting to fair value

2.Qualitative Judgement

Deciding on positions taking into account strategist's qualitative judgement

3.Risk Control

Risk Control by monitoring deviations from SAA and TE

Quantitative model

Assessing relative value among assets based on leading macro indicators and current valuation

Strategist

Qualitative assessment on each asset class based on market outlook provided by monthly investment meetings and major asset managers

- Determine recommendation level for each asset class, synthesizing the two assessments above

- Decide the optimal TAA for each SAA with risk constrains

Fund selection

Based on the result of our unique and original fund evaluation, collaborating with our Fund Analysis Dept., we select qualified funds with the highest expectation of excess return for each asset class, and provide the information on how to combine these funds.