- Home

- Competitive Edge

Competitive Edge

Investment advisory services, seeking to improve client’s portfolio performance, utilizing future oriented fund evaluation that is not based on past track records, and providing optimal investment solutions through fund portfolio.

Concentration of Managerial Resources to Improve

Clients’ Investment Performance

Our history goes back to 1996 when a small trial team for fund analysis and evaluation was created within Nomura Securities. Since then, we have paid every effort to contribute to clients’ investment management and to improve their performance. Our passion for client value creation remains intact and we keep our managerial resources concentrated only for the benefit of our clients.

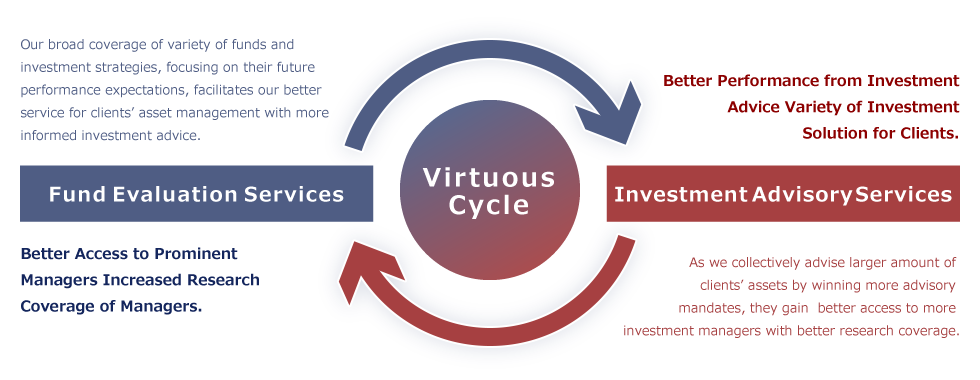

Synergistic virtuous cycle between proprietary fund evaluation services and investment advisory services

NFR&T, since its establishment, has provided investment advisory services, selecting funds with its own evaluation method, and supporting client’s fund portfolio combination/optimization in order to achieve our goal to serve client investment performance through fund evaluation. Our value for clients is being derived by evaluating future reliability of funds in the investable universe, not just by evaluating their historical performance. We have created over time its unique methodology, in which variety of hypotheses behind their past investment decisions are tested through extensive analyses of different level of facts.

We have utilized our expertise in qualitative fund evaluation in its investment advisory and gradually generated alpha for our clients’ portfolio through fund/manager selection advice. To date, we are one of the largest investment advisors in Japan, which provide investment advice only as manager-of-manager or fund-of-funds model portfolios.

Amount of our assets under advisory (“AUA”) shows how much trust we have won from clients, and its size also enhances our access to enhance wider range of funds and managers around the globe.

Aspire to further coordinated enhancement by research

and investment professionals

We are the pioneers of fund evaluation in Japan and has a team of the most experienced fund analysts and fund-of-funds portfolio managers, while many of them have been actively involved in investment money management in their previous careers. It is our belief that real experiences in equity and/or fixed-income portfolio management and investment decision-makings should benefit their judgment in fund evaluations as well as investment advisory. Such our belief is presented in the profile of our experienced professionals and uniquely featured in qualities in our services.

We continue to enhance our core skills, such as fund evaluation and portfolio construction, through collective efforts by all the professionals. The entire process based on the same methodology in fund evaluation and portfolio construction is taken place in a systematic and documented manner and is followed by al the fund analysts as well as portfolio managers. Such team approach eliminates dependency on individual skills and knowledge , so that not only our process will not be affected by change in our personnel, but also all the improvements in our fund evaluation and portfolio construction can be pursed as a team effort.

Fund Evaluation Services

- · “Qualitative Evaluation” of Fund’s Future Prospects

- · Wide range of Fund under Coverage

- · Proprietary Global Research Platform and “On-site” Manager Interview

- · Broad Range of Clients for the Service

- · 20+years Experience and Track Record of Fund Evaluation

Investment Advisory Services

- · 15+years of Experience and Track Record of Investment Advisory

- · Japan’s top-sized asset under advisory

- · A Visionary Product Solutions

Competitive Edge

Investment advisory services, seeking to improve client’s portfolio performance, utilizing future oriented fund evaluation that is not based on past track records, and providing optimal investment solutions through fund portfolio.

Fund Evaluation Services

Pursuit to Measure Funds’ Future Prospect Unstinted Efforts to Access Their True Reliabilities, not Reflected in Past Performance.

Investment Advisory Services

With a great deal of experience, NFR&T boasts Japan’s top class asset under advisory. A visionary propositions solve various needs of asset management.